Highlights

● We propose a new approach to measure global economic policy uncertainty.

● The time-varying copula approach is employed to evaluate the dynamic dependence between global and national economic policy uncertainty.

● The global economic policy uncertainty generally presents a "Low-High-Low" tendency in the sample period.

● The degree of dependency in developed countries is much higher.

● The magnitude of global economic policy incoordination has improved obviously in the post-crisis period.

1.

Introduction

Many studies have explicitly focused on global economic policy uncertainty when investigating long-term economic performance and cyclical fluctuations (e.g., Fang et al., 2018). The heightened economic policy uncertainty can harm economic activity and financial stability (e.g., Bloom et al., 2007; Gulen & Ion, 2016; Juns, 2017; Mertzanis, 2018; Junttila & Vataja, 2018; Kim, 2019). To quantify "uncertainty", a number of empirical strategies have developed in the literature to proxy it (e.g., Bomberger, 1996; Ramey & Zubairy, 2014; Brogaard & Detzel, 2015; Baker et al., 2016; Castelnuovo et al., 2017).

The most influential methodology, the GEPU (Global Economic Policy Uncertainty) index, proposed by Davis (2016) is constructed based on Baker et al. (2016). An unexpected fluctuation of the GEPU index is usually reflected in booms and busts of real activities in the US and a number of other countries (Baker et al., 2016; Caggiano et al., 2017; Yu et al., 2018). It has been borrowed in a number of empirical applications, such as fluctuation characteristics (Yu & Song, 2018; Dai et al., 2019) and influence effects (Foniaine et al., 2007; Meinen and Roehe, 2017; Huang et al., 2018; Rehman, 2018; Zhou et al., 2019).

However, the measuring method of the GEPU index in Davis (2016) has limitations. The measuring method Davis (2016) used to construct the GEPU index is based on the GDP-weighted average of national economic policy uncertainty and a regression-based method to impute missing values. GDP data from the IMF's World Economic Outlook Database are presented in a quarter or annual frequency and take some time to update. Since the index of global economic policy uncertainty should be sensitive to some specific events, the weight of the GEPU index should be time varying. To address these drawbacks, we use a new approach which is not limited to data frequency and data update to measure the GEPU index.

The GDFM (Generalized Dynamic Factor Model) is considered in this study to measure global economic policy uncertainty. This model was introduced by Forni et al. (2000) and Forni and Lippi (2001), see also Stock and Watson (2002). Since the economic policy uncertainty in various countries affects the global economic policy uncertainty, the co-movement between them can represent the global economic policy uncertainty. The generalized dynamic factor model can be adopted to analyze these common factors. This dynamic approach encompasses all other ones and (beyond the usual assumptions of second-order stationarity and existence of spectral densities) basically does not place any structural constraints on the data-generating process (Barigozzi & Hallin, 2016; Forni et al., 2017; Anderson et al., 2018).

Over the recent decades of globalization, the world has interacted more closely than ever before. On the hand, individual economy has a closer link to the other world's economies (Granville et al., 2011; Basnet & Sharma, 2015; Enge et al., 2017; Liow et al., 2018). On the other hand, the dynamics of the international markets can also affect the real economies of individual countries (Mallick & Sousa, 2013; Olbrys at al., 2017; Bildirici & Badur, 2018). A large body of research recently established that economics policy uncertainty can influence movements in real and financial variables of economies (Caeda et al., 2016; Balli et al., 2017; Guo et al., 2018; Cekin et al., 2019; Christou & Gupta, 2019). In connection with the similar experience, we contribute the nascent literature by analyzing the dependence structure of EPU.

Following previous studies (Patton, 2006; Boero et al., 2011; Min & Czado, 2014), we employ three families of time-varying copulas to evaluate the dynamic dependence between global and national economic policy uncertainty. The time-varying copula approach allows us to investigate both the symmetric and asymmetric dynamic dependence relationship between global and national economic policy uncertainty (Oh & Patton, 2018; Ji et al., 2018). In the empirical analysis, we find a symmetric and positive value of static dependence between global and national economic policy uncertainty. In addition, the degree of dependence between global and developed countries EPU is much higher than that in developing countries EPU.

Our study contributes to the ongoing literature in the following aspects. Compared to Davis (2016), we apply a generalized dynamic factor model to reconstruct an index of global economic policy uncertainty. The new GEPU index based on the GDFM will not be limited to GDP data frequency and update. Furthermore, the new GEPU index is more flexible to reflect the co-movement between economic policy uncertainty. Finally, our study also examines the dynamic dependence structure between global and national economic policy uncertainty.

The remainder of the paper is organized as follows. In the next section, we outline the model, data sources, descriptive statistics, and the analysis of the GEPU index. The dynamic dependence analysis is provided in Section 3. Section 4 presents our conclusions.

2.

Reconstructing global economic policy uncertainty

2.1. Generalized dynamic factor model

Following the contribution of Barigozzi and Hallin (2016), we briefly present the construction of the generalized dynamic factor model (GDFM). The most general factor model representation of economic policy uncertainty, known as the general (or generalized) dynamic factor model, is

where the process ukt is orthonormal white noise (here the variable ukt will be called the GEPU_GDFM, implying the global economic policy uncertainty measured by generalized dynamic factor model); polynomials bik(L) are one-sided and have square-summable coefficients; the common component GEPUt is driven by pervasive factors, that is, the Qth eigenvalue of its spectral density matrix diverges as N→∞ for almost all frequencies in the range [−π,π]; the idiosyncratic component Zit is stationary and possibly autocorrelated, but only mildly cross-correlated, that is, the eigenvalues of its spectral density matrix are uniformly bounded as N→∞; the common component and the idiosyncratic component are mutually orthogonal, that is, they are uncorrelated at all leads and lags; Q is the smallest integer for above constraints.

According to the model introduction, we can get the common fluctuation of multiple time series. The common factor here represents the overall dynamic change process of all indicator. Compared to Davis (2016), his method does not consider the frequency of the index or sample size. Moreover, instead of counting weights, our method is more flexible to extract all the common trends of information. Indicators of global economic policy uncertainty measured by our methodology are more robust and more suitable for empirical analysis.

2.2. Data sources and descriptive statistics

The global economic policy uncertainty is constructed by employing national EPU indices for 20 countries which are available on the companion website1. 20 countries that enter into the GEPU index account for about 70% of global output. They are: Australia (AUS), Brazil (BRA), Canada (CAN), Chile (CHI), China (CHN), France (FRA), Germany (GER), Greece (GRE), India (IND), Ireland (IRE), Italy (ITA), Japan (JPN), Mexico (MEX), the Netherlands (NET), Russia (RUS), South Korea (KOR), Spain (SPA), Sweden (SWE), the United Kingdom (UK), and the United States (US). Meanwhile, it is appropriate to determine the number of these countries, and excessive sample size will affect the estimation of model parameters. In order to maintain the integrity of the data, the sample period is March 2003 to November 2018. The economic policy uncertainty index provided by Baker et al. (2016) can be obtained directly from the companion website.

In Table 1, we report the descriptive statistics of the national economic policy uncertainty used in the sample period. France and the United Kingdom present high average values with 193.699 and 216.553 respectively. It indicates a high degree of economic instability. The United Kingdom also experienced maximum standard deviation, attesting increasing volatility of economic policy uncertainty. All national economic policy uncertainty indexes are positively skewed. Furthermore, two out of twenty national economic policy uncertainty indexes (Ireland and Sweden) show negative excess kurtosis and approximately normal distribution. Others are shown to be leptokurtic, indicating that they have fat tails and strongly reject the normality. Finally, Engle's (1982) test of conditional heteroscedasticity also shows strong evidence of ARCH effects for first-difference economic policy uncertainty indexes. The strong evidence of ARCH effects is conducive to enhancing the fluctuation of variable, so as to extract dynamic factor through the GDFM. Next, GDFM was used for empirical analysis.

2.3. Analysis of GEPU index

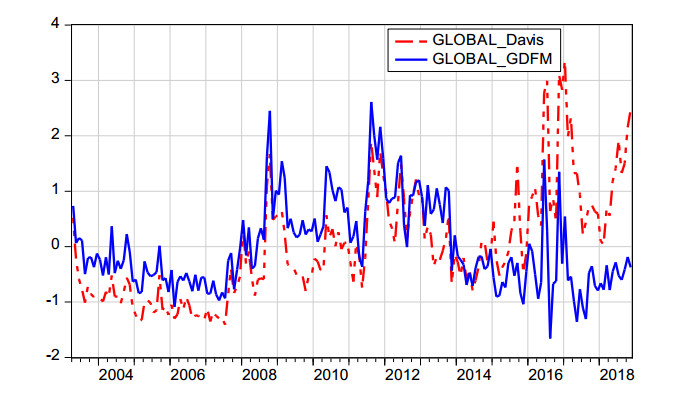

Figure 1 depicts the GEPU_GDFM index (global economic policy uncertainty index calculated by the author using the GDFM) and the GEPU_Davis index (global economic policy uncertainty index calculated by Davis, 2016). These two indexes exhibit similarities overall, indicating that we construct a reasonable proxy for global economic policy uncertainty based on the generalized dynamic factor model. Of course, the two measures also show some differences. For example, the elevation of GEPU_Davis levels in 2016–2017 is very dramatic but relatively modest in our calculation. The Global Financial Crisis in 2008-2009 and the Sovereign Debt Crisis of the Euro Zone are more prominent in the GEPU_GDFM index series.

Features of different phases of global economic policy uncertainty are clearly evident. In the first phase (from April 2003 to August 2008), the mean value of the GEPU_GDFM index is −0.38, suggesting that the global economic policy uncertainty is relatively low. The second phase (from September 2008 to October 2013) witnessed a sharp growth of economic policy uncertainty in the world. The GEPU_GDFM index fluctuates around consistently high levels, and the average of the index reaches 0.84 during this period. This corresponds well with the profound impact of the Global Financial Crisis. The last phase, which begins in November 2013, has recorded a rapid decline of global economic policy uncertainty. The mean GEPU_GDFM value index is −0.47, which is even smaller than that of the first phase. However, movements in the world policy-related economic uncertainty are more dramatic in the third phase.

The GEPU_GDFM index fluctuates with notable political events and development in the world. The index rises significantly in the reaction to special events like the Gulf War Ⅱ in 2003, Lehman Brothers failure in September 2008, the European sovereign debt crisis, the United States debt-ceiling crisis of 2011, China's generational leadership transition in 2012, the Brexit referendum in June 2016, and the US presidential election in November 2016.

3.

Dynamic dependence analysis

3.1. Marginal distribution

In this article, we adopt the GARCH-type model of conditional heteroscedasticity to fit the marginal distribution of economic policy uncertainty. Among GARCH-type models, effective and accurate models are indeterminable as they fit the marginal distribution of economic policy uncertainty. We follow the previous research (e.g., Kayalar et al., 2017) and adopt the standard GARCH model that adequately describes the marginal distribution of economic policy uncertainty without being too complicated. The preliminary results of the ARCH test shown in Table 1 support our decision to employ a GARCH (p, q) modelling approach for fitting marginal distribution of economic policy uncertainty index. Finally, the AR (1)-GARCH (1, 1) is selected by the Akaike Information Criterion (AIC).

3.2. Time-varying copula model

The copula models we consider here allow us to investigate both symmetric and asymmetric structure between global and national economic policy uncertainty. Following the settings presented in Patton (2012), Jin (2018) and Ji et al. (2018), we employ three families of time-varying copulas: elliptical copulas (normal and Student-t), the Archimedean copula (Clayton), and the rotated copula (rotated Clayton copula).

The optimal copula model for each global and national economic policy uncertainty pair can be further verified based on the minimum of the AIC values shown in Table 2. They show that the time-varying Student's t copula is the best one in eighteen out of twenty cases. It is consistent with the findings of majority of previous studies (e.g., Aloui et al., 2013; Ji et al., 2018). For the Global-Ireland and Global-Mexico pairs, the results suggest the time-varying normal copula as the best fitting model. It indicates that there is no significant evidence of asymmetric dependence between global and national economic policy uncertainty. In addition, there is no tail dependence in Global-Ireland and Global-Mexico pairs. Comparing the AIC values of the time-varying Clayton-type copula, this result shows that AIC values of the time-varying rotated Clayton copula are always lower than those of the time-varying Clayton copula. This demonstrates that the time-varying rotated Clayton copula can perform better than the time-varying Clayton copula in fitting the dependence structure of global and national economic policy uncertainty.

3.3. Result analysis

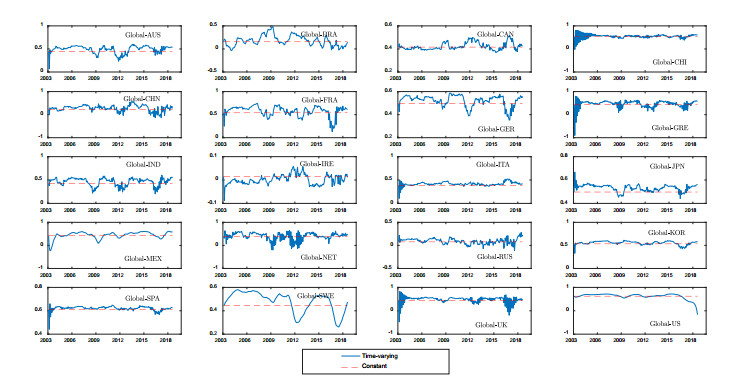

The time paths of time-varying copulas simultaneous with constant parameters of their static analogues are presented in Figure 2. There exists positive values of the static dependence between global economic policy uncertainty and that of each country, and the magnitude of dependence in developed countries (particularly in the US and Western Europe) is much higher. The constant parameter estimates (red line) of all copulas are larger than zero. However, the average of the copula value in developed nations reaches 0.418, which is around 38 percent greater than that in developing countries. In addition, the top 3 economies in the copula value are the US, Spain, and France, all belonging to the group of developed countries. On the contrary, among the bottom 3 economics, two countries (Russia and Brazil) come from the group of developing nations.

At all points, the degree of dependence between the global economic policy uncertainty and that of the 20 countries varies over time. Clearly, the time-varying dependencies between global and national economic policy uncertainty are not always positive (especially in 2003 and 2017), although this is the case for most of the time. The dynamic dependence parameter of developed economics is larger, which is in line with the static result. However, it can be seen that the copula number of global and the US, the largest developed country in the world, has experienced sharp decline since Trump's election in late 2016. Overall, the value of global and several developing nations (e.g., Russia, Mexico, India) has shown a slight increasing trend. Additionally, we note that the volatility of the dynamic dependence parameter in developing countries is relatively larger.

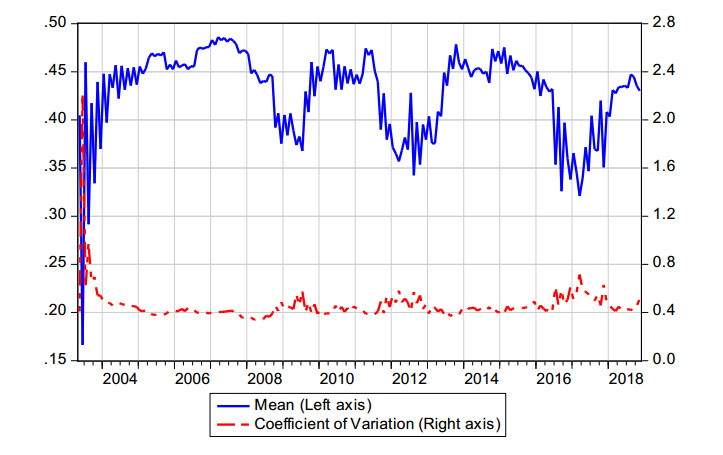

The graphical evidence reported in Figure 3 displays the unstable state of the average and coefficient of variation for the 20 countries' copulas over time. The magnitude of the international economic policy coordination changes through time. In the pre-crisis period (before September 2008) except the case before 2004, the larger mean value of copulas, as well as the smaller coefficient of variation, suggests that the degree of economic policy coordination among countries is clearly higher. In the post-crisis period, especially during the period November 2008 to July 2009, September 2011 to November 2012, and June 2016 to November 2017, and the average of the copula values declines and the coefficient of variation spikes. This is in association with the increase of international economic policy incoordination and even policy conflicts (e.g., monetary and fiscal policy conflicts) after the 2008–2009 global financial crisis.

In short, economic policy uncertainty in developed countries is still the main driver of world economic fluctuations, while the power of economic policy uncertainty in emerging market countries cannot be ignored, especially after the global financial crisis in 2008. In this context, global economic policy uncertainty needs to be more effectively measured.

4.

Conclusion

In this study, we apply a generalized dynamic factor model to reconstruct a new GEPU index. Subsequently, the time-varying copula approach is used to examine the dynamic dependence structure between global and national EPU. Our main findings can be summarized as: (1) the new GEPU index calculated by us using the GDFM is a reasonable proxy for global economic policy uncertainty compared with the GEPU index calculated by Davis (2016); (2) the time-varying Student's t copula is the best one to fit the dependence structure for most of global and national EPU pairs; (3) the GEPU index overall presents a "Low-High-Low" tendency during the period from April 2003 to November 2018, and it increases sharply in action to notable political events and development around the world; (4) there overall exists positive dependence between global and national economic policy uncertainty. The magnitude of dependency in developed countries (especially in the US and Western Europe) is much higher than that in developing countries, but this gap tends to decline; (5) the degree of international economic policy incoordination has improved significantly after the 2008–2009 global financial crisis.

The implications of this study are at least twofold. First, considering the closer connection between global economic policy uncertainty and that of developed economies, the investors, policymakers, and other economic entities concerned about the policy uncertainty around the world should pay more attention to the political events and development in developed countries. Meanwhile, with the increase of association with global economic policy uncertainty, the policy uncertainty from developing nations also should not be ignored. Second, there is a broad consensus that cooperative approaches to policy-making should be implemented at the global level (Ostry & Ghosh, 2016). However, the magnitude of international economic policy coordination has declined since the global financial crisis 2008–2009. In this sense, in order to raise the economic policy interdependence among countries, policy-making that considers a multilateral perspective is worth great attention.

Acknowledgements

This research was funded by the applied characteristic discipline business management of Hunan province, the humanity and social science foundation of Ministry of Education of China (19YJCZH108), and Collaborative Innovation Development Center of Pearl River Delta Science & Technology Finance Industry Project (NO.19XT01).

Conflict of interest

All authors declare no conflicts of interest.

DownLoad:

DownLoad: